Performance Marketing continued to grow significantly in 2021 and is now larger than display advertising as well as email marketing in driving conversions for brand merchants. Today, performance marketing represents over $6.8 billion dollars of ad spend each year (PMA).

Pay-per-call continues to be the rising star in performance marketing and with last year’s changes in regulations, data privacy, and security, 2022 will be a banner year for affiliates that drive quality, compliant calls through pay-per-call networks.

Affiliates that have traditionally focused on pay-per-click models will look to increase their earnings by reaching for the higher payouts that inbound calls have to offer, and they’ll be able to attract larger budgets from national brands with the ability to tie first-party data to consumer-initiated calls. On the other hand, advertisers in a variety of service categories will work with Outsourced Program Management Companies (OPMs), like Soleo, that specialize in managing pay-per-call affiliate programs to ensure they have competitive offers in this robust call marketplace.

A Short History of Pay-per-call Marketing: From a Humble Start to a Consistent Performer

The pay-per-call industry is now in a mature state after a few years of growing pains. The first big players in the pay-per-call space were yellow page businesses that generated calls through their relationship with major telecom carriers. Soleo, an early pioneer in pay-per-call, built systems for managing this carrier traffic including:

• Directory Assistance (DA) – calls that came from consumers who called directory assistance (411) or other information services

• Intercept – calls that came from consumers who dialed a business that was no longer in service and opt to be connected to a related business

• Voice search – calls that came from consumers who used voice search capabilities

Because these voice-based search algorithms could identify consumer intent, satisfied callers were likely to convert into customers. With this new source of leads, pioneer brands like Lending Tree and IHG Hotels & Resorts found remarkable success, and their competitors entered the market as well.

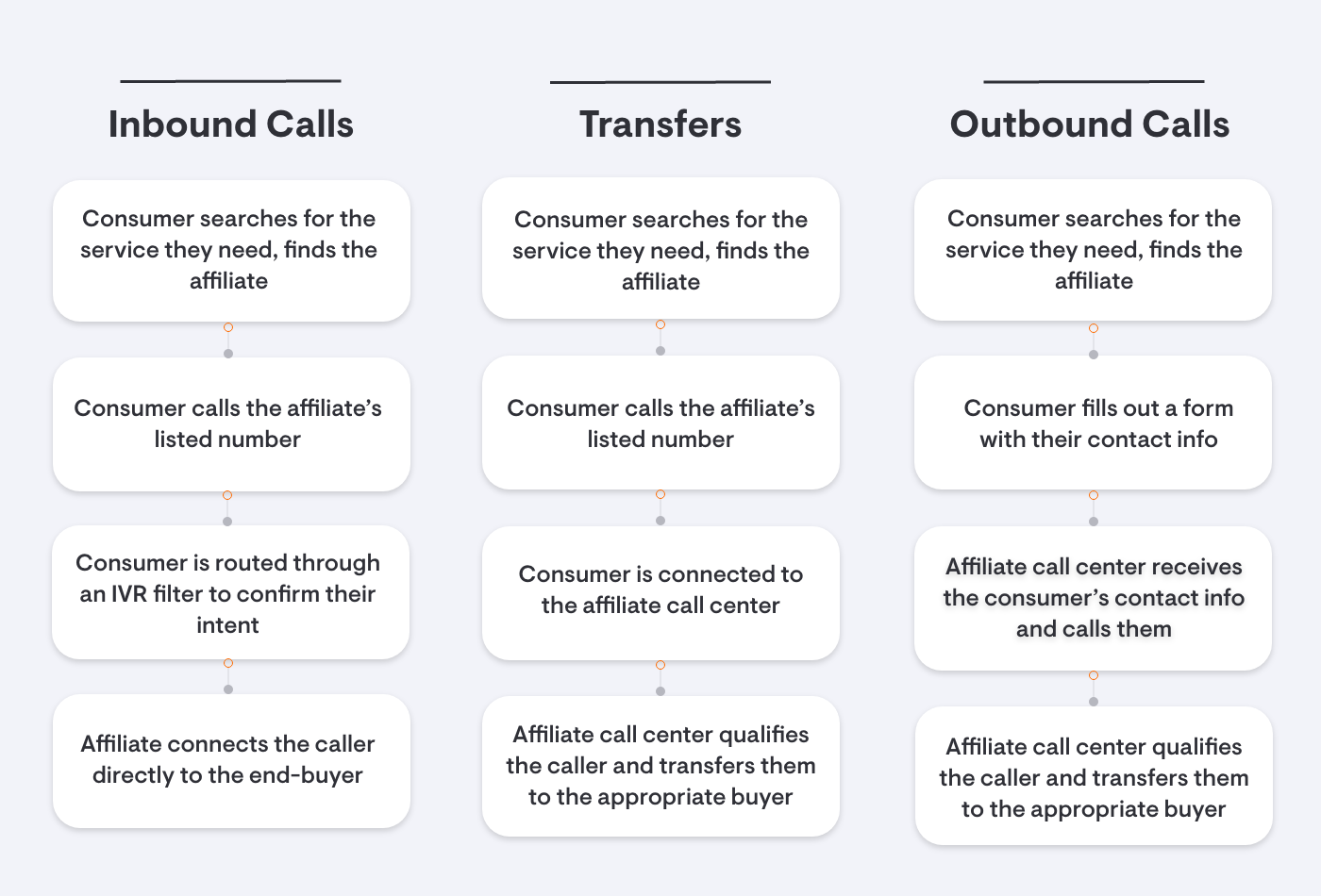

This attracted affiliates to the space who began to offer a variety of call-based leads: inbound calls (consumer-initiated), outbound calls (call center-initiated) and transfers (prequalified outbounds).

Take a look at the difference between inbound calls and other common call flows:

Unfortunately, like pay-per-click and other performance marketing models, fraudsters crept into the market. This led to the rise of OPMs that sorted through the good and the bad with a wide range of detection technology. Once the bad actors were responsibly managed, the pay-per-call industry continued to grow.

With more advertisers creating call-based offers, pay-per-call networks— businesses that work with both advertisers and affiliates to source competitive offers and generate a consistent volume of calls— established a solid footing. Brand name companies began using specialized networks to manage the large stream of affiliates that generated calls across a variety of mediums.

Compensation for call-based leads rose year-over-year and because these calls generated a consistent return on investment, the price for pay-per-call offers is now at an all-time high.

Fast-forward to Pay-Per-Call in 2022

The coming year is shaping up to be another blockbuster for the pay-per-call industry. A variety of external factors will continue to influence this rising trajectory.

After the initial surge of the Omicron variant, the world will try once again to put the global virus behind us. But work-from-home and the Great Resignation will stay with us, making consumers more comfortable calling for services than they did before the start of the pandemic.

Consumer spending is also expected to rise again, particularly for services and home services (Deloitte). Most service categories are well suited for the pay-per-call model and should benefit from these changing consumer patterns.

2022 will also accelerate the death of third-party cookies. Now three years after the General Data Protection Regulation (GDPR) has taken effect and with less spending on third-party data, more attention will focus on reliable first-party data, the kind that comes along with trackable leads from reputable sites (IBM). Pay-per-call networks will put more emphasis on matching incoming calls to their original source and the first-party data that will be collected along the way.

Another exciting trend in pay-per-call services is the accelerated implementation of Artificial Intelligence (AI) and Machine Learning (ML) to assist in driving conversions, all on a pay-for-performance basis. This includes front-end techniques for attracting consumers as well as automation, segmentation, personalization, and optimization during and after the call – all mechanized techniques that use a variety of data points to guide the consumer to the right place.

The Future of Pay-Per-Call: An Inbound-First Approach

For the last five years, outbounds and transfers have been commonplace in pay-per-call leads, and advertisers benefited from calls that were prequalified by third-party contact centers. As more affiliates entered the space, the pay-per-call industry became tightly regulated, and for good reason: the number of call transactions that were happening each day increased and the risk of violating a federal statute such as the TCPA became more threatening.

The direction in 2022 is toward better quality and more compliance. Because the highest-quality pay-per-call leads today are consumer-initiated calls, an inbound-first approach will become the de facto standard in pay-per-call. The underlying reasons for this trend are compelling:

• Compliance – inbound calls are made by the consumer and do not violate TCPA regulations

• Consumer Intent – inbound calls convert more frequently

• Consumer Journey – consumer-initiated calls provide a better consumer experience

• Brand Demand – national brands often will not buy transfers without knowing the source and pre-approving the consumer journey

To remain compliant with increasing regulations, pay-per-call networks implemented consent-based marketing initiatives, including a variety of lead verification tools. Call tracking, call recording, call transcription, and call analytics have also become standard tools for measuring conversions and compliance.

In addition to compliance measures to support recent laws and regulations, the best pay-per-call networks focus their energy on known owned & operated publishers and properties. The closer the lead’s origin is to the offer, the better quality it will be. First-party data can be collected, the consumer’s journey is better understood, and overall conversions are much higher.

The number of marketing channels that support pay-per-call landing pages and other call-oriented leads will continue to grow. Pay-per-call affiliate programs tend to be channel agnostic as long as the consumer journey is qualified and compliant. These channels can be both online and offline and will adapt to newer mediums like linear and CTV (Streetfight). Programmatic spending will drive fewer and fewer calls while quality referral and comparison sites drive more.

Call management technology will continue to adapt to changes in these marketing initiatives and to changes in consumer behavior. A strong pay-per-call program starts with a strong OPM that has the tools, resources, and experience to navigate through these changes. The net result is quality, compliant calls from consumers that may not have called the brand otherwise but are willing to convert.

The return on investment from pay-per-call offers is clear, measurable, and sustainable regardless of the endless changes in market dynamics.